One of the most substantial operating expenses for a brick and mortar business or any business that requires office space is the cost of renting commercial space. Before searching for office rentals, you must understand what expenses you can expect to incur.

The cost of commercial property is dependent upon numerous factors, including the city, location, and size of the commercial space that you are seeking. In this article, we will briefly discuss the various cost associated with commercial leases and the calculations that you should conduct prior to committing to a commercial lease.

Commercial Property Rental Rates

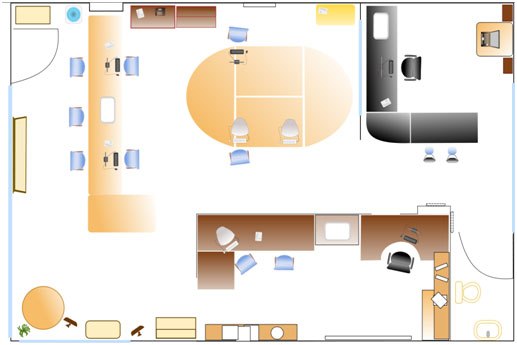

During your search for commercial property to rent, you will see advertisements, which may include figures such as “$50/SQFT.” This figure means that the rent is fifty dollars per square foot per year. Once you know the square footage of the commercial office space, you can then estimate your annual and monthly rent cost. In general, it is recommended that you allocate a minimum of 100 SQFT per employee. As such, you can calculate the number of employees you have (or expect to have) to estimate how much office space you need.

However, please note that this is just a starting point ora basic rent calculation, which is the cost before other expenses (i.e., utilities, maintenance fees, etc.) are calculated. Additionally, the building that the office rental is located in will impact the additional cost that you may incur. For example, a building with a doorman or luxurious lobby will increase the cost of the office rental.

In any event, your lease will define the additional costs you’re responsible for, but as explained below, each type of commercial lease agreement is different.

Different types of commercial leases

A gross lease is where the tenant pays a flat or fixed amount of rent, and the Landlord is responsible for expenses incurred in operating the building. As such, the Landlord pays the taxes, insurance, special assessments, etc.

A net lease is where the tenant pays the rent, and some defined percentage of the taxes, insurance, and maintenance fees.

A double net lease is where the tenant pays the rent, taxes, and insurance.

A triple net lease is where the tenant pays the rent, taxes, insurance, and operating cost. The triple net lease is commonly used in shopping malls.

A percentage lease is where the tenant’s rental rate is based in part on the gross sales made by the tenant on the premises. (e.g., a landlord receives $1000 per month and base rent and 5% of the total monthly profit). Percentage leases are commonly used in retail spaces

Step rent commonly referred to as “step-up rent” or a “step-up lease” is a clause in a commercial lease agreement where the rent may increase at specified periods during the tenancy.

For example, a step-up clause may indicate that the rent will increase by $100 per year to account for inflation. The methodology used for calculating step-up provisions varies from lease to lease. For example, the additional rent can be calculated as a fixed dollar amount, or it might be a percentage increase tied to a consumer price index, etc.

Your broker can help negotiate the terms of any rent increases or step-up rent provisions.

Usable Square Footage vs. Rentable Square Footage in Commercial leases

To avoid confusion during your search for commercial space, you must remember that there is a difference between the usable and rentable square footage of commercial space.

Usable square footage

Usable Square Footage only includes the square footage that is exclusively for use by you, the tenant. The usable square footage calculation is what you should use to determine whether a potential space will meet the needs of your business. Typically, an office rental’s usable square footage isn’t advertised.

Rentable Square Footage

Rentable square footage includes usable square footage plus a percentage of all the shared office space in the building. This calculation contains things such as shared restrooms, cafeterias, the lobby, and stairways that your employees can use. Additionally, rentable square footage also includes areas that the tenants do not have access to, such as maintenance areas.

More than likely, in a commercial lease, the monthly rent will be calculated based on the rentable square footage, as commercial tenants are expected to help cover the cost of maintaining the entire building.

Loss Factor

Once you are familiar with the useable square footage and the rentable square footage, you can then calculate the “Loss Factor,” which is the percent difference between the usable square footage and the rentable square footage.

(RSF – USF) / RSF = Loss Factor

Essentially, the loss factor equation indicates the total “markup” on your monthly or annual rent. The Industry standards for Loss Factor vary by location and industry, but anything over 40 percent is usually considered excessive.

The Cost of Building Out an Office Space to Meet Your Needs

Unless you’re lucky to find space that already fits your needs, you may need to build out the commercial space you’ve chosen to meet your business needs. For example, you may need to transform a former restaurant into a retail space or vice versa. Sometimes, Landlords may contribute to the cost of renovations by offering rent concessions to give the tenant time to build out space before opening for business.

How to Calculate Your Target Rent Based on a Percentage of Your Gross Income

To ensure that you are keeping your rental cost reasonable, you can calculate your target rent amount as a percentage of your gross income. The standard gross-to-rent rate varies amongst different industries but is typically under 10 percent.

According to Hartman, one of Houston, Dallas, and San Antonio’s premier property management companies, the following are examples of standard gross-to-rent percentages from a variety of industries.

- 46 percent: Gambling establishments

- 12 percent: Gas stations

- 09 percent: Electronics and appliance stores

- 66 percent: Educational services

- 82 percent: Finance and insurance companies

- 19 percent: Arts, entertainment and recreation facilities

- 21 percent: Food and beverage shops

- 30 percent: Books, hobby, music, sporting goods stores

- 37 percent: Health and personal care stores

- 46 percent: Insurance agents and brokers

- 86 percent: General merchandise stores

- 52 percent: Health care and social assistance organizations

- 81 percent: Food and drink establishments

- 98 percent: Furniture and furnishing stores

- 7 percent: Hotels, accommodations

- 66 percent: Clothing and accessory shops

- 55 percent: Ground transportation companies

How to Calculate the Percentage of Your Sales that will go towards your rental expenses

To calculate what percentage of your gross sales will go towards your rental expenses, use the following equation:

(annual rent/yearly gross income) =Percentage of Your Sales that will go towards your rental expenses

For example, let’s say your rent is $1,000 per month, and your gross annual income is $240,000.

- First, calculate the annual rental cost. ($1,000 *12) = $12,000

- Next, divide the annual rent by your gross annual income

If your annual rent is $12,000, you would then divide $12,000 by $240,000. ($12,000/$240,000) =.05

Your total would come to 5 percent

This percentage means that for every $1 your company earns, 5 cents go toward the rent.

Knowing this calculation is critical to determine the maximum amount of rent you can comfortably afford for your business. Specifically, this is helpful if you are looking to upgrade your commercial space, but you want to ensure that you still meet your income goals.

Featured Image Credit: By The Photographer / Own work, CC0